It has been ongoing for a while already. If not, perhaps the first idea would be: It is Christmas. Time for good news. In this purpose, of course, the German Chancellor Angela Merkel does not want to be outdone. Following the news, you might almost think, Angela is realizing that “at the top of every european tree are golden lights for all to see”, referring to the old Christmas poem “Knecht Ruprecht” (Santa´s helper) of Theodor Storm. Ireland, Portugal, Italy, Spain, even Greece! It seems the euro crisis is solved. And would that not be the most lovely Christmas gift? Mass unemployment decreasing, the losses in income suffered since the outbreak of the financial and euro crisis in 2007/2008 at least offset.

However, a closer examination of what Miss Fortune, Angela Merkel, wants to make us believe, reveals: it as a mere misfortune. Alas! Damn it, it is Christmas! Perhaps it is the cane of austerity, spending and wage cuts, chastising the so called countries in crisis. And who is the most ruthless swinging the cane? Your´re right, is is Angela.

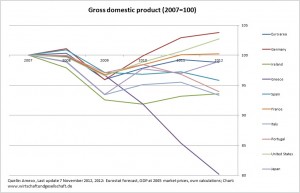

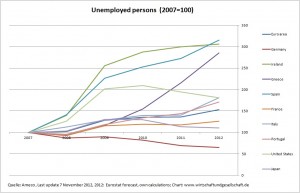

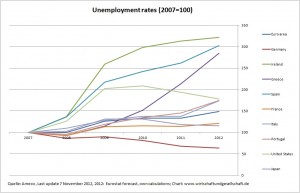

Let us therefore step back for a moment to escape all those golden lights and look at a few sober figures. How have income and unemployment developed since the outbreak of the crisis 2007/2008? To account for that we took levels in 2007 as 100. And here is the result:

Among the so called countries in crisis surveyed no country has returned to its pre-crisis level so far; France only meanders along the level; Greece´s GDP is in free fall.

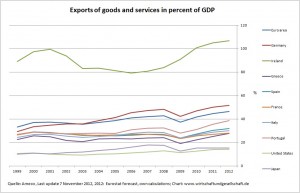

Even the GDP of Ireland has not yet substantially improved. That is noteworthy because the “Troika´s” and especially Germany´s recipe to overcome the crisis is to enhance competetivness, i.e. the ability to sell more products and services abroad. Ireland´s share of exports of goods and services in GDP is above 100 percent. This is unique. It is hardly possible that many economies, let alone bigger economies, can steadily earn more abroad than domestically. There must be someone who buys it. Compare the export shares of the other economies: Even the export-junkie Germany has a share of around 50 percent, which is already astronomically high; in the other economies the share is well below that of Germany and Ireland. However, despite its unique export share of goods and services in GDP and growing exports, Ireland has not yet reached pre-crisis levels.

The development of export shares since 1999 and since 2007 by the way indicates, too, that Germany, which surpassed pre-crisis levels, has not pulled itself out of the swamp. Since years Germany´s high current account surplus determines its economic development – continuously celebrated by German politicians, economists and journalists. Thus, it is not only GDP which has surpassed pre-crisis levels but the export share, too. The share of goods and services in GDP has increased further since 2007 from 47.1 percent to 51.6 percent. The resulting current account surplus is paid by the rest of the world running corresponding deficits and increasing its debts – exactly those debts Germany´s government is at the same time draconially combatting. Life is full of seemingly contradictions!

Against the background of this poor performance, it is not very much surprising that unemployment has not decreased, but increased. Among the countries surveyed official unemployment figures have only improved in Germany. Since unemployment is still very high in the US, and Japan still fights deflation and unemployment, too, it is still appropriate to speak of a global economic crisis.

If it were up to “Knecht Ruprecht”, the christmas poem of Theodor Storm we cited already above, “both young and old should have rest away from cares and daily stress.” Merkel, however, still prefers to shout: “The cane’s there!” Unfortunately, she does not hit “those naughty ones who have it applied to their backsides”, as Knecht Ruprecht does. She would have to punish herself! But perhaps the Knecht Ruprecht, Theodor Storm sang about, is yet to come and everything will become fine. That is my wish for Christmas:

“Knecht Ruprecht, old fellow, it cried,

hurry now, make haste, don´t hide!”

—

Wirtschaft und Gesellschaft – Analyse und Meinung (Economy and Society – Analysis and Opinion) has a as well and is happy if you “follow” or “like” us.

We would be happy, too, if you would like to financially support us through a one time gift or by voluntary subscription. You can do so by simply sending your contribution to:

Account holder: Florian Mahler

Banking house: INGDiBa

Bank Account Number: 5400653788

Bank Code Number: 500 105 17

Reason for Payment: wirtschaftundgesellschaft.de

Dieser Text ist mir etwas wert

|

|

Alltag im Regierungsviertel

Alltag im Regierungsviertel